Development and application of an optimization model for overseas oil and gas production benefits

-

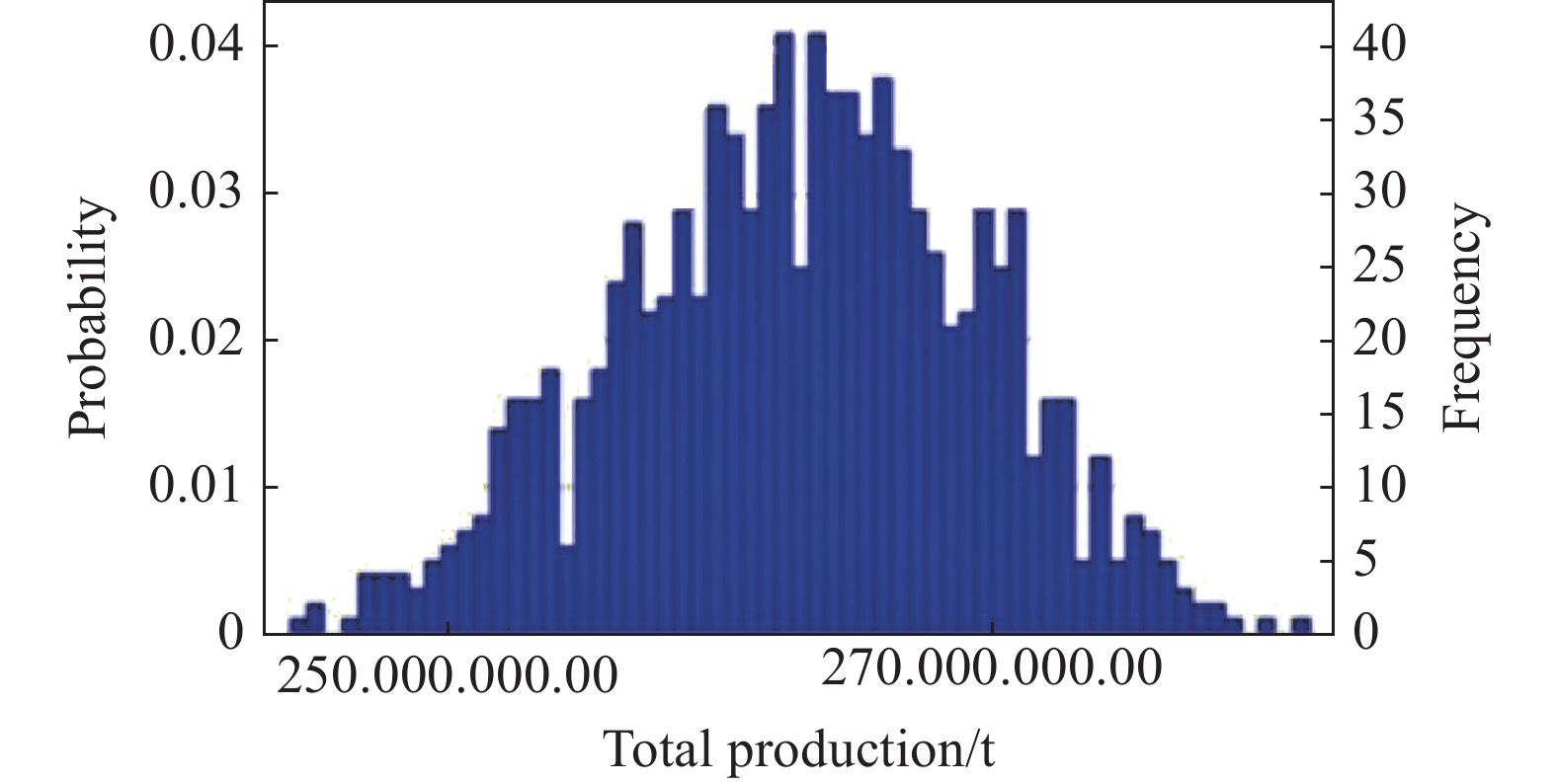

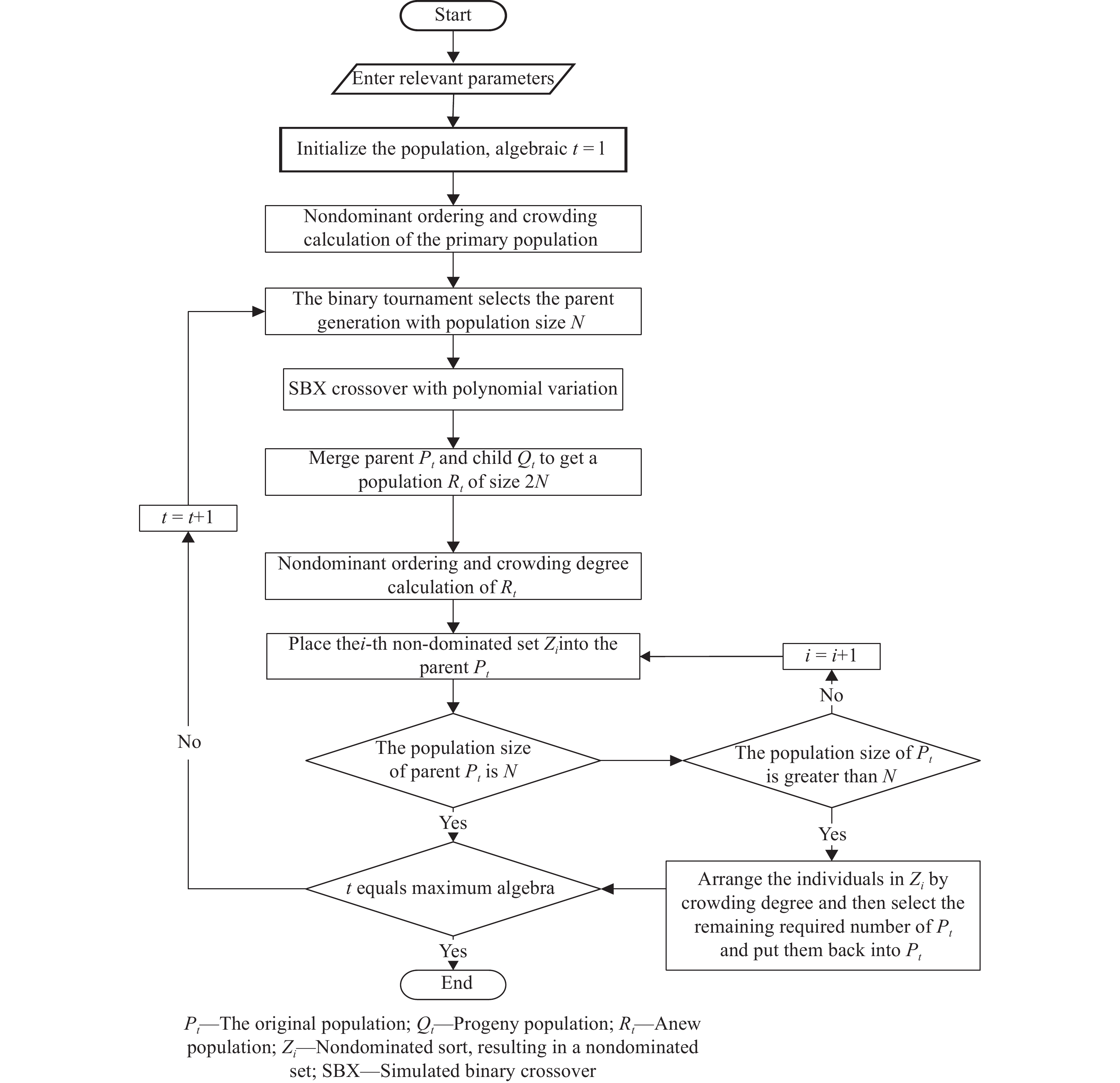

摘要: 效益最大化是國際石油公司生產經營的永恒主題,油氣產量是效益實現的載體,提高效益產量則是海外資產保值增值的必然途徑. 針對目前國內公司對于海外項目開展提質增效的一系列做法,亟待建立一套能夠兼容油價震蕩、適應海外項目,并滿足不同需求的綜合效益產量決策方法,助力海外項目提質增效. 針對海外項目不同于國內項目的特點,分析了礦稅制、產量分成、服務合同等不同油氣項目合同模式下的效益實現特點及策略;并基于國內外調研分析,建立了一套不同效益條件(成本、產量等指標浮動)下的海外項目效益產量評價邏輯框架,以整體邊際效益、現金流、利潤優化目標為決策點,指導效益配產,實現資產增值保值;在兼顧收益性與風險性的基礎上,創建全效益多維度效益產量決策模型并設計求解算法,在滿足石油公司的投資、成本等多種約束條件下,考慮產量、利潤、風險等多個決策目標,給出海外油氣田項目開發的全維度最優決策區間,即帕累托解集. 將創建的模型應用于海外油田具體案例,給出一定決策目標下的帕累托效益最優決策區間,并對解集中的每個解進行深度分析比選,提出按不同決策偏好選取不同的對應解,從而滿足效益經營決策的客觀性及科學性. 最后考慮不確定性因素的影響,分情景對方案產量、油價、成本及投資等的不確定性進行分析,取得較好的應用效果,為制定海外油田效益產量優化方案、資產保值增值提供可靠的決策支持.Abstract: Benefit maximization is the enduring objective of production and management for international oil companies. This objective can only be realized through oil and gas production; thus, enhancing production efficiency inevitably leads to maintaining and increasing the value of overseas assets. Given the current practices adopted by domestic companies to improve the quality and efficiency of overseas projects, it is imperative to establish a set of comprehensive benefit and output optimization methods that can withstand oil price shocks, adapt to overseas projects, and cater to various other requirements, thereby serving to improve the quality and efficiency of overseas projects. Taking into account the differences between overseas and domestic projects, this paper analyzes the characteristics and strategies for realizing benefits under different financial and tax regimes, such as mine tax contracts, output-sharing contracts, and service contracts. A framework for evaluating the benefits and outputs of overseas projects under different conditions (such as cost, output, and other floating indicators) is established based on research and analysis conducted at home and overseas. Overall marginal benefit, cash flow, and profit optimization objectives are used to guide benefit allocation to achieve asset appreciation and preservation. A multidimensional and multi-objective decision-making model and an algorithm for benefit maximization are developed by considering both profitability and risk. A Pareto solution set is provided for a comprehensive optimal decision-making interval of overseas oil and gas field project development by considering the constraints of investment, cost, and block in conjunction with multiple decision-making objectives such as production, profit, and risk. This model was applied to specific cases of overseas oil fields under certain decision objectives, and the Pareto optimal decisions were generated. An in-depth analysis and comparison of each solution in the solution set was conducted. Appropriate selection of different solutions is advocated for different decision preferences to ensure the objectivity and scientific nature of profit management decisions. Finally, considering the influence of uncertainty factors, the scenario-based uncertainty analysis of the project output, oil price, cost, and investment has proved effective and generally provides reliable support for decision making in the context of overseas oilfield efficiency and plans for production optimization and high-quality development. The benefit production model and solving algorithm for overseas oilfield projects developed in this paper can provide a theoretical basis and support for decision making by oil field companies to optimize the production benefits of overseas oil fields and improve profitability.

-

表 1 效益產量模型要素集

Table 1. Element set of the benefit yield model

Element Interpretation $ {x}_{ij} $ Whether to exploit the jth field project in the ith block $ {q}_{ij} $ Maximum production from the jth field project in the ith block $ {Q}_{\mathrm{t}\mathrm{a}\mathrm{r}\mathrm{g}\mathrm{e}\mathrm{t}} $ Total target production $ {p}_{ij} $ Net profit of the jth oilfield project in the ith block $ {c}_{ij} $ Net cash flow from the jth oilfield project in the ith block $ {r}_{ij} $ Combined risk for the jth field project in the ith block, which is a weighted average of field reserve risk, political risk, and oil price risk, weighted and scored by experts in field development planning $ {i}_{ij} $ Investment in the jth oil field project in the ith block $ {o}_{ij} $ Operating cost of the jth oilfield project in the ith block $ {m}_{ij} $ Management costs for the jth oilfield project in the ith block $ {s}_{ij} $ Cost of sales for the jth oilfield project in the ith block $ {e}_{ij} $ Financial costs for the jth oilfield project in the ith block $ \mathrm{N}\mathrm{P}\mathrm{V}\left(a\right) $ a discounted to the net present value in the year of decision $ {C}_{1} $ Lower limit of operating cash flow per unit of production for inventory production $ {C}_{2} $ Lower bound on operating costs per unit of production $ {C}_{3} $ Lower bound on payout costs $ {C}_{4} $ Lower bound on return on investment in new production $ {C}_{5} $ Lower bound on total profit $ {C}_{6} $ Lower limit of total production $ {C}_{7} $ Total investment cap 表 2 效益產量建模用目標函數

Table 2. Objective function used in benefit yield modeling

Objective function Function formula Sequence number Yield maximization $\mathrm{M}\mathrm{a}\mathrm{x}\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{q}_{ij}$ (1) Minimize yield

differential$\mathrm{Min}\left(\right|{Q}_{\mathrm{t}\mathrm{a}\mathrm{r}\mathrm{g}\mathrm{e}\mathrm{t} }-\mathrm{M}\mathrm{a}\mathrm{x}\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{q}_{ij}\left|\right)$ (1*) Profit maximization $\mathrm{Max}\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{p}_{ij}$ (2) Maximize cash flow $\mathrm{Max}\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{c}_{ij}$ (3) Minimize operating cost per unit $ \mathrm{Min}\frac{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}{x}_{ij}{o}_{ij}}{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}{x}_{ij}{q}_{ij}} $ (4) Minimize unit cash cost $ \mathrm{Min}\frac{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}{x}_{ij}({o}_{ij}+{m}_{ij}+{s}_{ij}+{e}_{ij})}{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}{x}_{ij}{q}_{ij}} $ (5) Minimize risk $\mathrm{Min}\mathrm{M}\mathrm{a}\mathrm{x}\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{r}_{ij}$ (6) 表 3 效益產量建模用約束條件

Table 3. Constraint conditions for benefit yield modeling

Constraint Function formula Sequence number Lower limit of operating cash flow per unit of production $\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}({c}_{i}+{i}_{i})\geqslant{C}_{1}$ (7) Upper limit of operating cost per unit of production $ \frac{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}{x}_{ij}{o}_{ij}}{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}{x}_{ij}{q}_{ij}}\leqslant{C}_{2} $ (8) Upper limit of payout cost $\frac{\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}({o}_{ij}+{m}_{ij}+{s}_{ij}+{e}_{ij})}{ \displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{q}_{ij} }\leqslant{C}_{3}$ (9) Lower limit of return on investment for new production volume $ \frac{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}\displaystyle\sum_{t=2021}^{T}{x}_{ij}NPV\left({c}_{ij}^{t}\right)}{\displaystyle\sum_{i=1}^{m}\displaystyle\sum_{j=1}^{n}\displaystyle\sum_{t=2021}^{T}{x}_{ij}NPV\left({i}_{ij}^{t}\right)}\geqslant{C}_{4} $ (10) Lower limit of total profit $\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{p}_{ij}\geqslant{C}_{5}$ (11) Lower limit of total production $\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{q}_{ij}\geqslant{C}_{6}$ (12) Total investment upper limit $\displaystyle\sum _{i=1}^{m}\displaystyle\sum _{j=1}^{n}{x}_{ij}{i}_{ij}\leqslant{C}_{7}$ (13) Required constraint-block constraint $\mathrm{f}\mathrm{o}\mathrm{r}\mathrm{ }\mathrm{e}\mathrm{a}\mathrm{c}\mathrm{h}i,\displaystyle\sum _{j=1}^{n}{x}_{ij}\geqslant n$ (14) 表 4 效益產量決策優化常用模型及表達式組合

Table 4. Common models and expression combinations for benefit yield decision optimization

Decision optimization model Type Expression Combination Model I:

Maximize the production and minimize the risk given the ROI constraints, cash flow, and the

range of profits achievedObjective function:(1), (5)

Constraint:(7), (10), (11), (14)Model II:

Maximize the profit and cash flow and minimize the unit operating costs given the ROI

constraints, payout costs, and range of productionObjective function:(2), (3), (4)

Constraint:(9), (10), (12), (14)Model III:

Given the yield target $ {Q}_{\mathrm{t}\mathrm{a}\mathrm{r}\mathrm{g}\mathrm{e}\mathrm{t}} $ and investment constraints, profit, and unit operating cost

requirements, minimize yield deviation and risk

Objective function:(1*)(5)

Constraint:(8), (11), (13), (14)Notes:ROI means return on investment. 中文字幕在线观看表 5 效益產量最優決策區間

Table 5. Decision intervals for benefit yield optimization

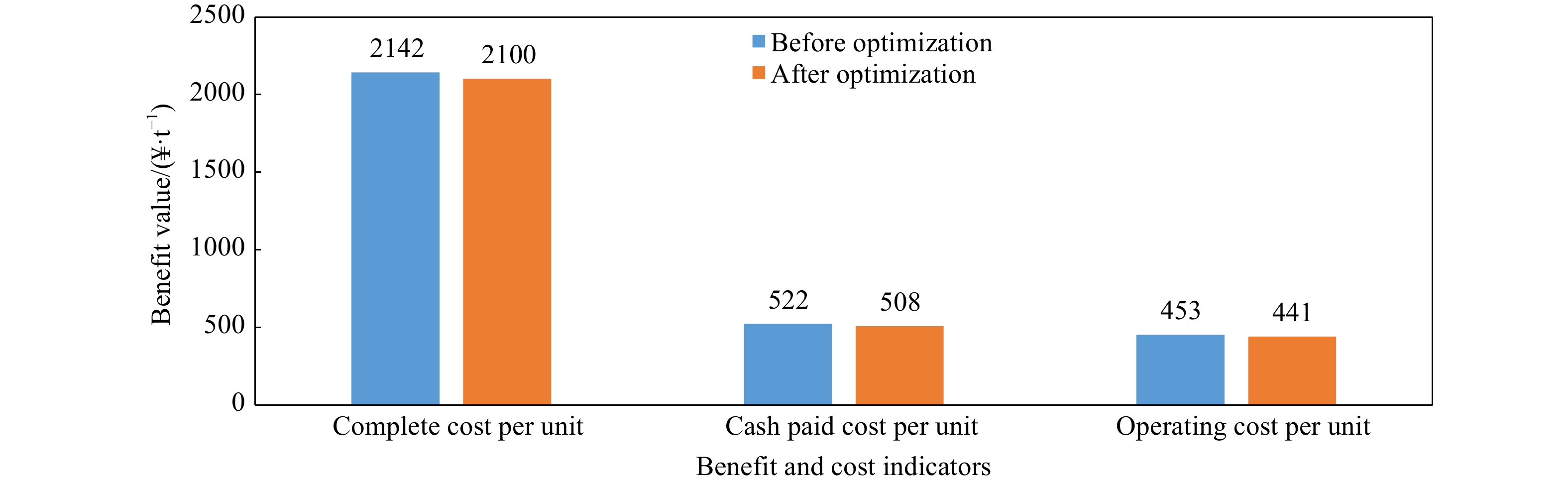

Preferred

solution setEquity oil and

gas production/tProfit/¥ Operating cash flow/¥ Risk Unit operating costs/

(¥·t?1)Unit cash paid

cost/ (¥·t?1)Total number

of oil fields1 37310841 4009049828 7094331796 20.4 436.8 504.0 36 2 37258035 3968636467 7806138825 16.8 441.0 508.2 21 3 37341255 3963712429 7399291824 18.8 441.0 508.2 29 4 36716835 3290670240 9689161738 14.1 449.4 516.6 9 5 37502802 3513549687 7006716908 21.3 441.0 508.2 39 6 36723054 3804018854 9127457671 16.4 441.0 508.2 19 7 36605850 3693330144 9536101806 13.8 449.4 516.6 9 8 36881063 3877670734 8692999494 17.2 441.0 508.2 23 9 36829709 3782262111 9512866333 15.2 445.2 512.4 14 10 37012710 3961423106 7745694098 17.1 441.0 508.2 22 -

參考文獻

[1] Du J J, Zhang G H, Liu H B. Summary of oil economic output research. J Univ Petroleum, 2000(3): 12杜吉家, 張光華, 劉洪波. 石油經濟產量研究綜述. 石油大學學報(社會科學版), 2000(3):12 [2] Huang A Q. Study on the Evaluation of Development Benefit and Investment Portfolio Optimization on Offshore Oilfield [Dissertation]. Beijing: China University of Petroleum (Beijing), 2018黃安琪. 海外油田開發效益評價及投資組合優化[學位論文]. 北京: 中國石油大學(北京), 2018 [3] Harrison G H, Tweedie J A. A multi-objective economic analysis of oilfield production policy // SPE Annual Technical Conference and Exhibition. San Antonio, 1981 [4] Zhang Q, Li P C, Liu L J. Multi-objective optimization of oilfield development plan based on quantum-shuffled frog-leaping algorithm. Inf Contr, 2014, 43(1): 116張強, 李盼池, 劉麗杰. 基于量子混合蛙跳算法的油田開發規劃多目標優化. 信息與控制, 2014, 43(1):116 [5] Song J K, Zhang Z X, Zhang Y. A stochastic chance-constrained programming model for measures program. Microcomput Inf, 2007, 190(3): 192宋杰鯤, 張在旭, 張宇. 油田措施配置的隨機機會約束規劃模型. 微計算機信息, 2007, 190(3):192 [6] Li W. Model of Multi-Objective Decision-Making Based on Agent and Application in Oilfield Development [Dissertation]. Daqing: Northeast Petroleum University, 2011李偉. 基于Agent的多目標決策模型及在油田開發中的應用[學位論文]. 大慶: 東北石油大學, 2011 [7] Zhang Y Y, Ye P. A new solution method to oilfield development and programming model. Inn Mong Petrochem Ind, 2010, 36(3): 111 doi: 10.3969/j.issn.1006-7981.2010.03.055張圓圓, 葉鵬. 基于信賴域算法的油田開發規劃模型研究. 內蒙古石油化工, 2010, 36(3):111 doi: 10.3969/j.issn.1006-7981.2010.03.055 [8] Chi G T, Wang H Z, Cheng Y Q. Oilfield development planning model and application based on reserve value assessment. Res Financ Econ News, 2010, 320(7): 34 doi: 10.3969/j.issn.1000-176X.2010.07.005遲國泰, 王化增, 程硯秋. 基于儲量價值評估的油田開發規劃模型及應用. 財經問題研究, 2010, 320(7):34 doi: 10.3969/j.issn.1000-176X.2010.07.005 [9] Li B, Bi Y B, Gao G L. Risk assessment and analysis of oilfield development planning. Spec Oil Gas Reserv, 2016, 23(2): 63 doi: 10.3969/j.issn.1006-6535.2016.02.015李斌, 畢永斌, 高廣亮, 等. 油田開發規劃風險評估與分析. 特種油氣藏, 2016, 23(2):63 doi: 10.3969/j.issn.1006-6535.2016.02.015 [10] Gai Y J, Chen Y M, Fan H J. A multiple objective optimization under parameter uncertainty for measure program of oil field. Syst Eng Theory Pract, 2002, 22(2): 131 doi: 10.3321/j.issn:1000-6788.2002.02.023蓋英杰, 陳月明, 范海軍. 油田措施配置多目標隨機規劃. 系統工程理論與實踐, 2002, 22(2):131 doi: 10.3321/j.issn:1000-6788.2002.02.023 [11] Aseeri A, Gorman P, Bagajewicz M J. Financial risk management in offshore oil infrastructure planning and scheduling. Ind Eng Chem Res, 2004, 43(12): 3063 doi: 10.1021/ie034098c [12] Tan Y J, Ji X Y, Wang T Z. Uncertain programming model and algorithm for oilfield development planning under SEC criterion. Oper Res Manag Sci, 2020, 29(7): 25檀雅靜, 計小宇, 王天智, 等. 基于SEC準則的油田開發規劃不確定優化模型及算法. 運籌與管理, 2020, 29(7):25 [13] Wang Z X. Multi-objective uncertainty optimization model of oilfield development planning and its application. Petrol Geol Oilfield Dev Daqing, 2020, 39(5): 86 doi: 10.19597/j.issn.1000-3754.201912030王志新. 油田開發規劃多目標不確定性優化模型及其應用. 大慶石油地質與開發, 2020, 39(5):86 doi: 10.19597/j.issn.1000-3754.201912030 [14] Hu J, Liu Z B. Nonlinear fuzzy and comprehensive evaluation model of oilfield development program. J Oil Gas Technol, 2011, 33(10): 132 doi: 10.3969/j.issn.1000-9752.2011.10.031胡娟, 劉志斌. 油田開發規劃的非線性模糊綜合評價模型. 石油天然氣學報, 2011, 33(10):132 doi: 10.3969/j.issn.1000-9752.2011.10.031 [15] Feng L J, Guo D L, Zhong Y H, et al. Production composition optimization model based on multiple criteria and multi-constraint levels linear programming. Oil Plan Eng, 2009, 20(6): 14馮利娟, 郭大立, 鐘儀華, 等. 多準則多約束水平的油田開發規劃產量構成優化模型. 石油規劃設計, 2009, 20(6):14 [16] Yang Y Q, Li S Y. Opportunity constraint and compromise planning model for oilfield development planning. Stat Decis, 2008, 259(7): 55 doi: 10.13546/j.cnki.tjyjc.2008.07.023楊永青, 李樹榮. 油田開發規劃的機會約束妥協規劃模型. 統計與決策, 2008, 259(7):55 doi: 10.13546/j.cnki.tjyjc.2008.07.023 [17] Kang X J, Li Z M, Liu Z B. Optimal model of oilfield development programming under stochastic oil price. Petrol Explor Dev, 2007, 201(6): 765 doi: 10.3321/j.issn:1000-0747.2007.06.023康小軍, 李兆敏, 劉志斌. 隨機油價下的油田開發規劃優化模型. 石油勘探與開發, 2007, 201(6):765 doi: 10.3321/j.issn:1000-0747.2007.06.023 [18] Yang L, Liu J, Yang X P. Risk identification and coping strategies of overseas oilfield development project investment decision. Int Petrol Econ, 2022, 30(3): 97 doi: 10.3969/j.issn.1004-7298.2022.03.012楊莉, 劉鈞, 楊希濮. 海外油田開發項目投資決策風險識別及應對策略. 國際石油經濟, 2022, 30(3):97 doi: 10.3969/j.issn.1004-7298.2022.03.012 [19] Fan Z X, Wang R F, Xu A, et al. HAIWAI YOUTIAN KAIFA FANGAN SHEJI CELUE YU FANGFA. Beijing: Petroleum Industry Press, 2021范子菲, 王瑞峰, 許安, 等. 海外油田開發方案設計策略與方法. 北京: 石油工業出版社, 2021 [20] Deb K, Pratap A, Agarwal S, et al. A fast and elitist multiobjective genetic algorithm: NSGA-II. IEEE Trans Evol Comput, 2022, 6(2): 182 -

下載:

下載: